Choosing the right health insurance plan can be challenging, especially with so many options available. In both the USA and Canada, selecting a suitable plan requires careful evaluation of healthcare needs, budget, and coverage options.

The first step is assessing personal or family healthcare needs. Individuals with chronic conditions or frequent doctor visits may benefit from plans with higher premiums but lower out-of-pocket costs. Healthy individuals may choose plans with lower premiums and higher deductibles.

In the USA, network coverage is an important factor. Many plans require policyholders to visit in-network doctors and hospitals to receive full benefits. Out-of-network care can be significantly more expensive. Understanding provider networks helps avoid unexpected bills.

Canadian residents choosing private health insurance should focus on coverage for prescription drugs, dental care, vision services, and specialist consultations. These services are often not fully covered under public healthcare plans.

Cost comparison is another crucial step. Comparing premiums, deductibles, copayments, and annual out-of-pocket maximums provides a clearer picture of total expenses. Online comparison tools can help consumers find competitive rates.

Coverage limits and exclusions should be reviewed carefully. Some health insurance plans exclude certain treatments or have waiting periods. Reading policy documents helps avoid future disputes and surprises.

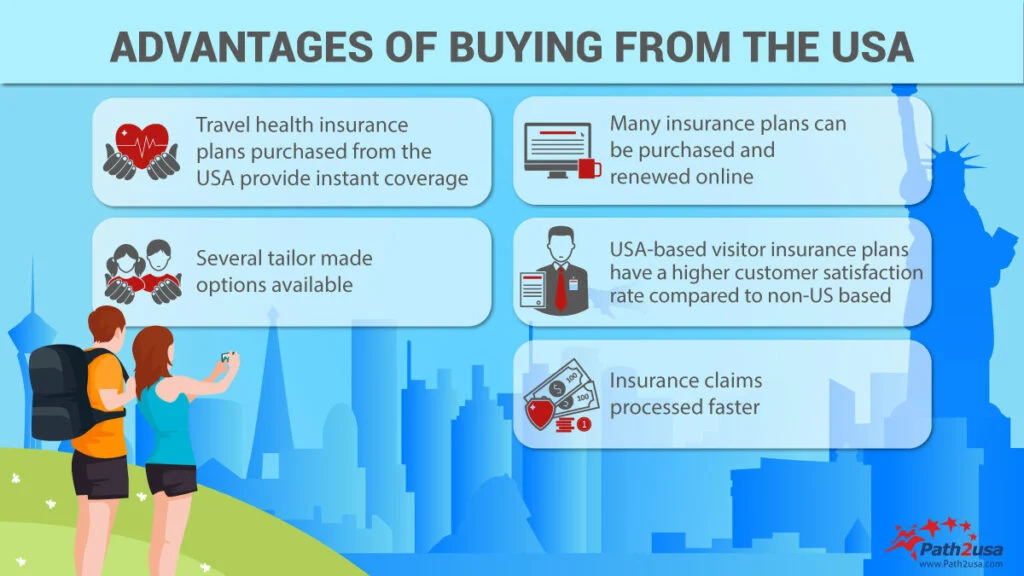

Customer service and insurer reputation also matter. Reliable insurance companies offer efficient claims processing, responsive support, and transparent policies. Reviews and ratings can provide useful insights.

In summary, choosing the best health insurance plan requires research and planning. By understanding coverage options and comparing providers, individuals can secure reliable and affordable health insurance in the USA and Canada.

Leave a Reply